|

Replies: 31

| visibility 451

|

Hall of Famer [22180]

TigerPulse: 100%

Posts: 8721

Joined: 9/11/11

|

Paying their fair share

3

May 6, 2024, 4:10 PM

|

|

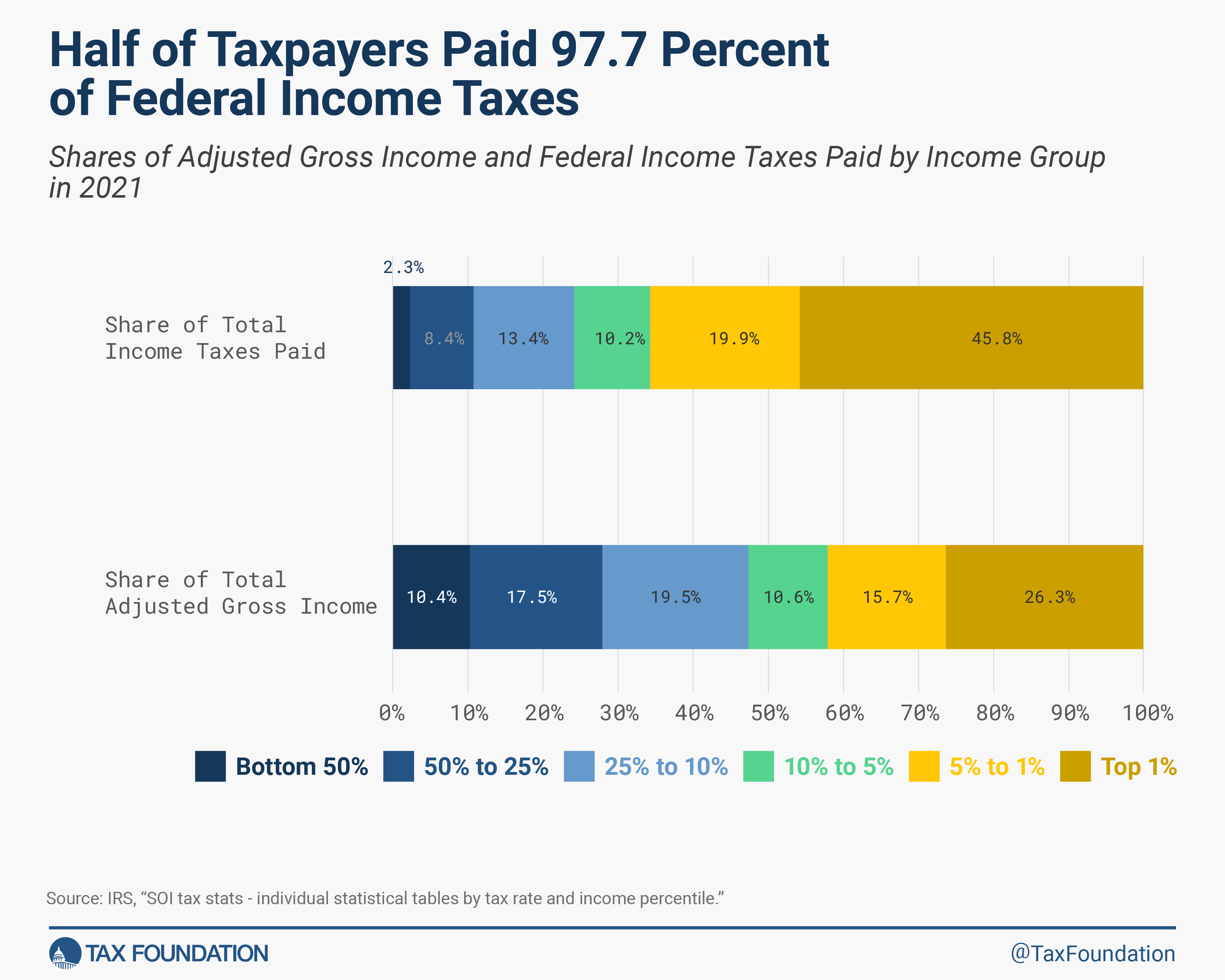

before we begin this discussion, what exactly is fair share? half? proportionate to income / earnings? that always bugged me...

Anyways, the narrative around blue teamers stating they're going to "fix things" by forcing the 1% of earners to "pay their fair share" has always astounded me, in that so many people in this country (and the globe, quite frankly) buy into this.

It's majorly flawed in two ways:

1- Even IF you disproportionately taxed the 1% of earners so they're "paying their fair share" then you still wouldn't come close to the roughly (help me here, guys, salestimating) ~$2T annual shortfall. So this notion is the equivalent of dropping your pants and pissing north off a cliff with a stiff & steady 15 mph NNW breeze in your face.

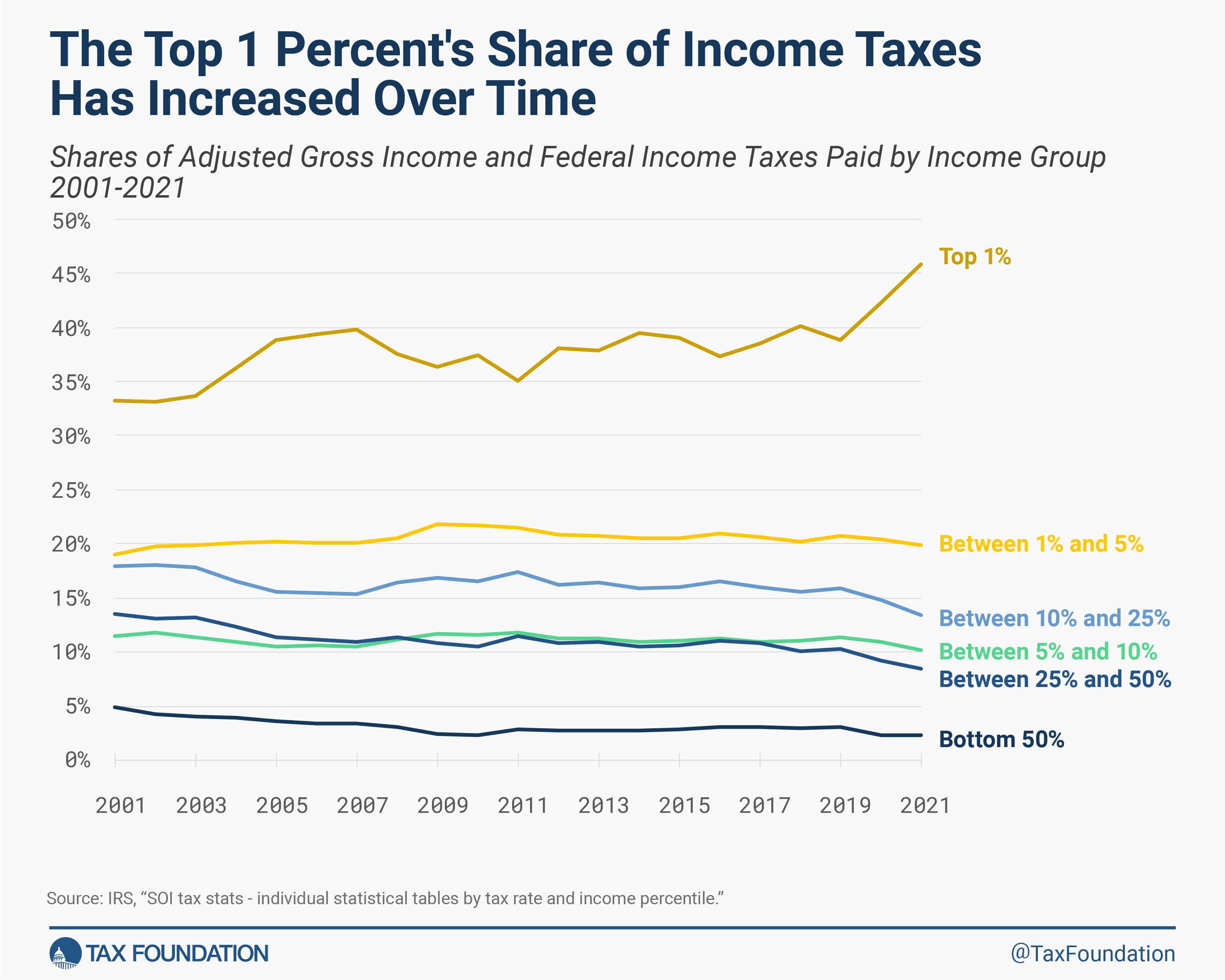

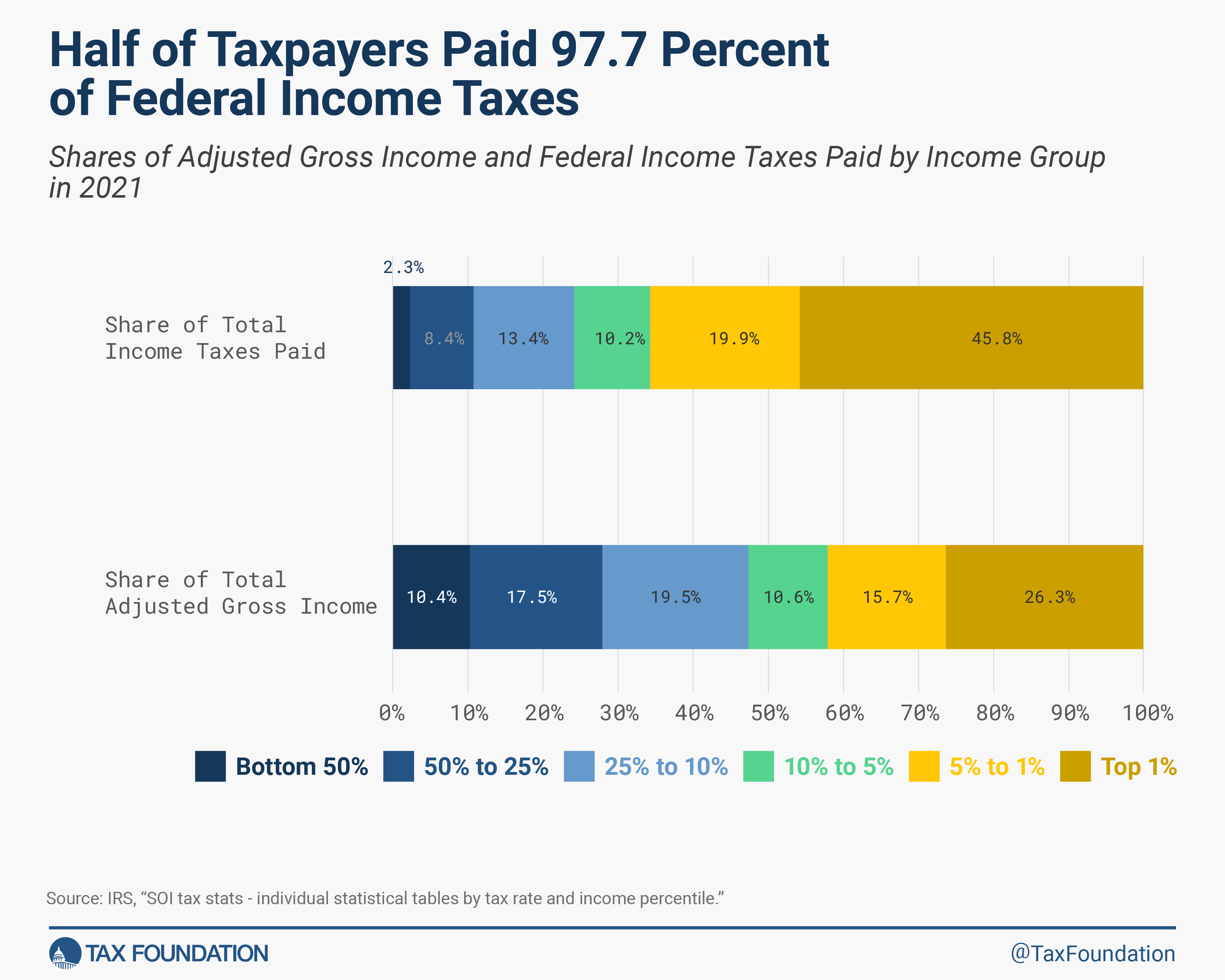

2- I always felt the 1% of earners, and subsequent next 10% of earners where I'm sitting, were already massively paying more taxes than the bottom 90% of the workforce. I never found a chart to show this, until today.

10% of the country is paying ~75% of the income taxes. What more do you people want?

Here's an idea, slash the government and stop ####### taxing me.

Obviously this is 2021 data, so Donnie Pump was part of this too, as he's a big government spending bootlicker just like the rest of you clowns.

Sauce: https://taxfoundation.org/data/all/federal/latest-federal-income-tax-data-2024/

|

|

|

|

|

110%er [7313]

TigerPulse: 96%

Posts: 9850

Joined: 10/6/21

|

Re: Paying their fair share means - - -

2

May 6, 2024, 4:29 PM

|

|

- - - setting the stage to take money from the upper-middle class earners so that they have to liquidate their IRA’s and savings accounts.

Similar to how it went with the original iteration of ObamaCare, when Dear Leader himself promised that IbamaCare would never be used for non-citizens’ healthcare.

|

|

|

|

|

|

110%er [7313]

TigerPulse: 96%

Posts: 9850

Joined: 10/6/21

|

Re: Paying their fair share

2

May 6, 2024, 4:59 PM

|

|

FYI, Trump touted his tax cuts as being targeted for middle income earners. He never sold it as a tax cut for the wealthy.

Of course, the top 0.1% of ‘net wealth’ people have very little in reportable earnings.

I can give you a small timer’s ’rich person’ example of how income taxes can be minimized.

The small timer ‘high income’ earner first works with his tax accountant to set up a corporation. By-laws and all that jazz gets set up. Thus, the ‘corporation’ is set up to deduct ‘expenses’ from the corporation’s earnings so that the CEO of the corporation can buy stuff that they use for personal purposes, but yet get legally categorized as deductions (I.e., gasoline, car maintenance, boat upkeep, etc). For material goods expenditures such as automobiles, these are ‘purchased by the corporation’ and simply used for the majority of mileage as ‘business expense.’ The other conspicuous stuff (boats, fancy home electronics, etc) also gets categorized as ‘expenses if the corporation gets set up to reasonably own those assets for the purpose of getting business.

Back to the top 0.1% of wealthy people. They have far more complex ‘corporations’ or LLC’s or non-profits from which to hide the truly big amount of money that passes through their hands.

These new IRS taxation proposals are unlikely to cost the super-rich an additional nickel.

|

|

|

|

|

|

All-TigerNet [13348]

TigerPulse: 100%

Posts: 14378

Joined: 11/2/15

|

Doesnt ol lunch pail Biden have a lot of these?

May 6, 2024, 10:07 PM

|

|

“Back to the top 0.1% of wealthy people. They have far more complex ‘corporations’ or LLC’s or non-profits from which to hide the truly big amount of money that passes through their hands.”

Weird, some even in his grandkids names. Wonder what services his grand daughter provided Serbia?

|

|

|

|

|

|

All-TigerNet [13348]

TigerPulse: 100%

Posts: 14378

Joined: 11/2/15

|

Flat tax. Everybody pays.***

2

May 6, 2024, 5:00 PM

|

|

|

|

|

|

|

|

Heisman Winner [112336]

TigerPulse: 100%

Posts: 74043

Joined: 9/10/03

|

Re: Flat tax. Everybody pays.***

May 6, 2024, 8:45 PM

|

|

FLat tax would be great for people in the highest tax brackets, not so much for the rest of us. Why are you promoting a tax plan that does not help you, but instead helps people making more than 400k a year? That makes no sense.

|

|

|

|

|

|

All-TigerNet [13348]

TigerPulse: 100%

Posts: 14378

Joined: 11/2/15

|

You run a company and make less than 400k?***

May 6, 2024, 9:39 PM

|

|

|

|

|

|

|

|

Heisman Winner [112336]

TigerPulse: 100%

Posts: 74043

Joined: 9/10/03

|

no, and intersting deflection

May 6, 2024, 10:38 PM

|

|

you do understand the difference between payroll and corporate taxes, you seem very confused.

|

|

|

|

|

|

Standout [304]

TigerPulse: 72%

Posts: 285

Joined: 10/18/23

|

|

|

|

|

|

Oculus Spirit [98128]

TigerPulse: 100%

Posts: 65118

Joined: 7/13/02

|

The biggest sham is what most Americans consider "wealth".

5

5

May 6, 2024, 6:48 PM

|

|

Below is a video of a billionaire on his 300-foot yacht. Guess what his INCOME is? $1.00 a year. ONE FREAKING DOLLAR. That's his salary. That's his taxable "income". EVERYTHING HE OWNS, all of the money he obtains, comes from capital gains, on which he's generally taxed at 13%. This guy will never pay a 39% tax on anything. A good heart surgeon will though. But Zuck here earned $700 million in dividends last year, which are taxed as capital gains, again 13%, unless he rolls them back into the stock, which he will.

What the really rich people do is they never sell their asset, as that's the basis for their wealth. Instead, they take out loans, using their wealth as collateral for the loan, then they sell only what assets are needed to service the debt (again taxed as capital gains).

And here comes Biden rallying the voters with his sock it to the rich tax plan to increase capital gains. I did a double take, until I read the fine print. Biden's capital gains tax hike means that IF you EARN $1 million or more per year, AS INCOME, then anything you sell that is capital gains will be taxed at the same rate as income, ostensibly like 39%. Guess what capital gains rate old Zuck here will pay, with his massive $1.00 a year income.......13%, same as a plumber selling his stock, even with Biden's plan.

It's all a sham.

https://x.com/CitizenFreePres/status/1787506722933805165

|

|

|

|

|

|

Hall of Famer [24497]

TigerPulse: 100%

Posts: 12486

Joined: 9/1/14

|

Re: The biggest sham is what most Americans consider "wealth".

May 7, 2024, 7:58 AM

|

|

And, they get to write off the interest for the collateralized loan. This write off is definitely something that needs to end.

|

|

|

|

|

|

Oculus Spirit [98128]

TigerPulse: 100%

Posts: 65118

Joined: 7/13/02

|

Biden's plan hits those at the top of the INCOME list.

1

May 7, 2024, 8:40 AM

|

|

But those are not the top 1% in WEALTH, or the "richest" Americans. This only impacts good lawyers, doctors, architects, engineers, etc. Successful small business owners too. But it does NOT ADDRESS those truly at the top of the "wealth" list. The "billionaires" who own $1 billion or more of SOMETHING, yet have no income to speak of.

The worst part though, is there is no real way to tax wealth without lowering everyone's income. That's the catch22. Now states do this through property taxes, but that's limited to real estate, in that state. But if a true federal "property tax" on stocks, and other investments ever materialized, it would tank the economy. Income tax is real money, as it has been exchanged for labor, or some sort. In a sense it's "pure" money, tied directly to labor expended to earn it. IF you start taxing market valuations of an asset, that's the end of everything, and the dominoes will all come crashing down. The relation of labor to dollars MUST remain intact, as dollars "earned" through market appreciation/demand are not tied to labor, and that undermines the legitimacy of the currency.

One theory on our recent bout of inflation was due to the mysterious influx of federal revenue that happened right as inflation spiked. The cause was hush hush, even though the Treasury knew #### well what was flooding federal coffers. It was capital gains payments from assets being sold. A large-scale influx of money from capital gains means there's a large influx of money not exchanged for labor. When that money is realized through the sale of the asset, it becomes fuel for the economy, AND inflation.

That's just one of many theories, but it's likely at least a contributing factor.

|

|

|

|

|

|

Orange Blooded [4911]

TigerPulse: 99%

Posts: 4927

Joined: 1/8/19

|

Re: Paying their fair share

3

May 6, 2024, 7:36 PM

|

|

Class warfare has never been based on anything other than raw emotion which is how most leftists make every decision. Not a lot of logical thought, or thought period, among the crowd that would gladly drag you out of your home and murder you in the street if they could get away with it and since they can't, yet, they will gladly vote for people who promise to steal as much of your money as possible.

|

|

|

|

|

|

Standout [336]

TigerPulse: 89%

Posts: 728

Joined: 8/3/23

|

Go touch some grass, youve spent way too much

May 6, 2024, 8:18 PM

|

|

time on the internet.

|

|

|

|

|

|

All-In [42536]

TigerPulse: 100%

Posts: 38574

Joined: 11/30/98

|

|

|

|

|

|

Hall of Famer [20591]

TigerPulse: 100%

Posts: 11738

Joined: 10/15/02

|

Re: Paying their fair share

May 7, 2024, 9:01 AM

[ in reply to Re: Paying their fair share ] |

|

Whereas you are a paragon of virtue and rational objectivity without the slightest bit of hate in your heart.

Rock on.

|

|

|

|

|

|

Heisman Winner [112336]

TigerPulse: 100%

Posts: 74043

Joined: 9/10/03

|

wealthy peole do not pay income tax

4

May 6, 2024, 8:36 PM

|

|

and are not represented on this chart. 1 in 1000 people, or .1% own over 30% of the wealth, and growing, in this country, Most don't work, and and pay less than 15% in capital gains via The "Reagan Loopholes". They should be paying 35% like me, I think that is where us "blue people" have an issue.

|

|

|

|

|

|

110%er [7313]

TigerPulse: 96%

Posts: 9850

Joined: 10/6/21

|

Re: wealthy peole do not pay income tax

3

May 6, 2024, 9:05 PM

|

|

Forgive me for being squishy, but you are correct, and this is a bipartisan disgrace.

|

|

|

|

|

|

CU Guru [1633]

TigerPulse: 100%

Posts: 988

Joined: 8/26/10

|

Re: wealthy peole do not pay income tax

1

May 6, 2024, 9:52 PM

[ in reply to wealthy peole do not pay income tax ] |

|

Maybe there just shouldn’t be an income tax.

Who started it?

Why should a working person obeying the law get taxed on their income when a drug dealer doesn’t?

|

|

|

|

|

|

Orange Blooded [4030]

TigerPulse: 68%

Posts: 8134

Joined: 12/9/01

|

Re: wealthy peole do not pay income tax

May 7, 2024, 6:06 AM

|

|

There shouldn't. We should have a consumption tax.

|

|

|

|

|

|

All-TigerNet [11658]

TigerPulse: 100%

Posts: 9811

Joined: 5/17/02

|

^^^Racist

1

May 7, 2024, 8:45 AM

|

|

Consumption taxes penalize the poors since they have to spend all their money since they are poor.

|

|

|

|

|

|

Hall of Famer [22180]

TigerPulse: 100%

Posts: 8721

Joined: 9/11/11

|

not disagreeing with what you're saying

May 7, 2024, 1:48 PM

[ in reply to wealthy peole do not pay income tax ] |

|

but wasn't what I'm talking about.

how can asset wealthy people pay taxes? Unless it's property taxes?

I'm specifically talking about the top earners as that tracks to top tax payers.

at a very high level, I'm fine w/ rich people paying less taxes, b/c usually that translates to me paying less taxes.

do they get a (very #######) much bigger break? well yeah, they're loaded. do I care? no, because I'm paying less taxes. that's the goal.

|

|

|

|

|

|

Oculus Spirit [82043]

TigerPulse: 100%

Posts: 47143

Joined: 3/18/07

|

Like Balm said. The Top 1% aren't really represented here.***

2

May 6, 2024, 9:45 PM

|

|

|

|

|

|

|

|

110%er [7313]

TigerPulse: 96%

Posts: 9850

Joined: 10/6/21

|

Re: Like Balm said. The Top 1% aren't really represented here.***

1

May 6, 2024, 11:01 PM

|

|

Agreed. Yet, the tax increase will be positioned to hit the upper middle class (households that earn in the ~ $400K and up range) hard.

This will not make a huge difference in the budget.

Meanwhile, as TBalm wrote, the real B.S. artists won’t be touched.

|

|

|

|

|

|

Heisman Winner [112336]

TigerPulse: 100%

Posts: 74043

Joined: 9/10/03

|

it would be a problem if you live in Manhattan or San Fran,

1

May 7, 2024, 12:42 AM

|

|

but 400k buys you an RV and a boat if you are content with paying less than 750k for your home. This seems like a terrible problem to have right? Certainly, I strive for that kind of income, but it would be early retirement in the country on a lake, so the taxes would not bury me.

And not to sound like a broken record, but I live in Florida's 2nd wealthiest county per capita. I drive by 60-foot yachts that never budge, about 70% of the homes are unoccupied most of the year, and of course, the locals(they live in NY and Connecticut) fight tooth and nail to drive out development which keeps home prices high.

Something has to give here.

|

|

|

|

|

|

All-TigerNet [12328]

TigerPulse: 100%

Posts: 5426

Joined: 9/12/04

|

The Democrats love using the "1% need to pay their fair share"

4

May 7, 2024, 8:30 AM

|

|

but the reality is the 1% pay the very the amount of tax the DC political elites have established in the US Tax Code. As Tiggity explained - the top 1% aren't doing anything these political clowns in DC have not intentionally provided to them as an outlet to maintain their wealth and secure their future political contributions. These are not accidental tax code "loopholes" - they are campaign contribution bought and paid for tax code investments. The state of the US tax code is not an accident - it is an exercise in Congressional power where it is used to financially reward/punish and also modify desired behaviors based on what the elites in DC want at the time.

This overused "top 1% must pay their fair share" mantra is an emotion driven slogan that preys on the worst emotions of human beings - envy and hate. The very same call to emotion that every Marxist cause has used to rally support since Marx and Engles wrote about direct progressive taxes and government mandated property theft from "the rich" to pay for their de-humanizing Utopia.

The Democratic Party wants to grow the size and scope of the Federal Government. Every policy idea and budget proposal affirms Federal Government growth as their objective. We already cannot fund the current size/scope of the Federal Government based on current tax receipts - therefore the ballooning Federal debt.

What the Democrats ultimately understand is that the only way to continue with their expansion of Government spending is to find more tax dollars from more people. That is why we are now hearing "tax the rich" and "tax the wealthy" more so than "1%" in their language where the definitions of "rich" and "wealthy" are malleable and can be adjusted as needed.

The truth is that any attempt to pay for our current bloated Government, much less an increased spending Federal Government, will require the middle class to be a big bill payer because the wealthy class only has so much money and is only going to tolerate so much of it being ripped from their clutches by their bought and paid for political puppets. The politicos know this and must figure a way to slowly boil that massive middle class tax frog in the pot without us realizing it. So... they are going to keep moving that "rich" bar downward until it hits a lot of middle class folks.

The ultimate solution to fixing our budgetary mess and stopping the erosion of our individual liberty is to significantly cut the size and scope of the Federal Government with a return to our Constitutional moorings. Our system was intended and designed to be one where State/local governance was most prevalent with a very limited Federal Government mostly overseeing common defense, foreign policy, and interstate commerce/issues. It was never intended that the Federal Government would be the single arbiter of almost every social, cultural, and political issue of the day much less a cradle to grave benefits provider.

Today, the Governmental power distribution in the USA is almost the complete opposite of our original design. The DC elitist class has spent decades constructing a whole DC ecosystem designed to provide them with most of the real power in the USA. Any attempt to rip that power from them in a return to more State/local governance will most certainly be fought tooth and nail by the whole d.a.m.n.e.d DC ecosystem.

So... Chances are we'll continue down this road where a lot of the loudest DC politico bullhorns will continue the charade that if we just "tax the rich" it will solve all our budgetary problems. Yet at some point "the rich" will actually mean today's middle class and once that well of middle class tax dollars has been drilled and the Federal spending debt continues to rage well beyond it's tax receipts - the whole system will eventually fall over the financial cliff and our descendants will curse us for what we have done.

|

|

|

|

|

|

Hall of Famer [24497]

TigerPulse: 100%

Posts: 12486

Joined: 9/1/14

|

Re: The Democrats love using the "1% need to pay their fair share"

2

May 7, 2024, 8:38 AM

|

|

Seems like the government should be able to live on 4-5 trillion per year that is received in current Fed tax revenue.

|

|

|

|

|

|

All-TigerNet [12328]

TigerPulse: 100%

Posts: 5426

Joined: 9/12/04

|

But that's the thing about power - the more they get the more they want and

2

May 7, 2024, 8:55 AM

|

|

our Federal Government is loaded with those kinds of arrogant, elitist power hungry folks.

The simple equation is: Money + Control = Power. Their power increases with the more money they control and the dominate political parties wield it in such a way as to always increase their power while bludgeoning any who oppose them.

To be sure, there are a few Congressional voices in the swamp wanting to cut size/scope of the Federal Government but any serious proposal they offer languishes in committee where the DC elites from both parties ensure it dies.

|

|

|

|

|

|

All-In [42536]

TigerPulse: 100%

Posts: 38574

Joined: 11/30/98

|

|

|

|

|

|

All-TigerNet [12328]

TigerPulse: 100%

Posts: 5426

Joined: 9/12/04

|

Absolutely not... I'm all for closing every "rich person loophole" in the tax

2

May 7, 2024, 11:35 AM

|

|

code. Tax them to oblivion for all I care but where I probably disagree with you is that doing so would actually result in tax relief to the average American and a reduction in our Federal debt.

Our Federal Government is made up of spending addicts. Congress and the DC ecosystem have proven time and again that they are unwilling if not mentally incapable of not increasing their desire for more spending. The more the money they get - the more they spend.

They simply will not view any additional tax revenue from closing these loopholes as the real means to reduce our existing debt but would instead see it as an opportunity to increase spending even more. Sure - they would tout "deficit reduction" in selling it to the public but as they have in the past (without result) they will simply find ways to use the additional tax dollars to shore up their power by paying off preferred constituencies and funding ever more pork.

I have ZERO faith that with larger tax receipts our Congress will hold to current (much less reduced) spending levels, fully pay for the current budget, and use any leftover to reduce the debt. Instead - they will see the extra tax dollars as simply extra checks in the Government checkbook to be written for new and increased spending.

|

|

|

|

|

|

All-In [42536]

TigerPulse: 100%

Posts: 38574

Joined: 11/30/98

|

Re: Absolutely not... I'm all for closing every "rich person loophole" in the tax

1

May 7, 2024, 12:46 PM

|

|

...but where I probably disagree with you is that doing so would actually result in tax relief to the average American and a reduction in our Federal debt.

Well, nah, we agree there. I don't trust Congress to do this right, either.

|

|

|

|

|

|

Oculus Spirit [98128]

TigerPulse: 100%

Posts: 65118

Joined: 7/13/02

|

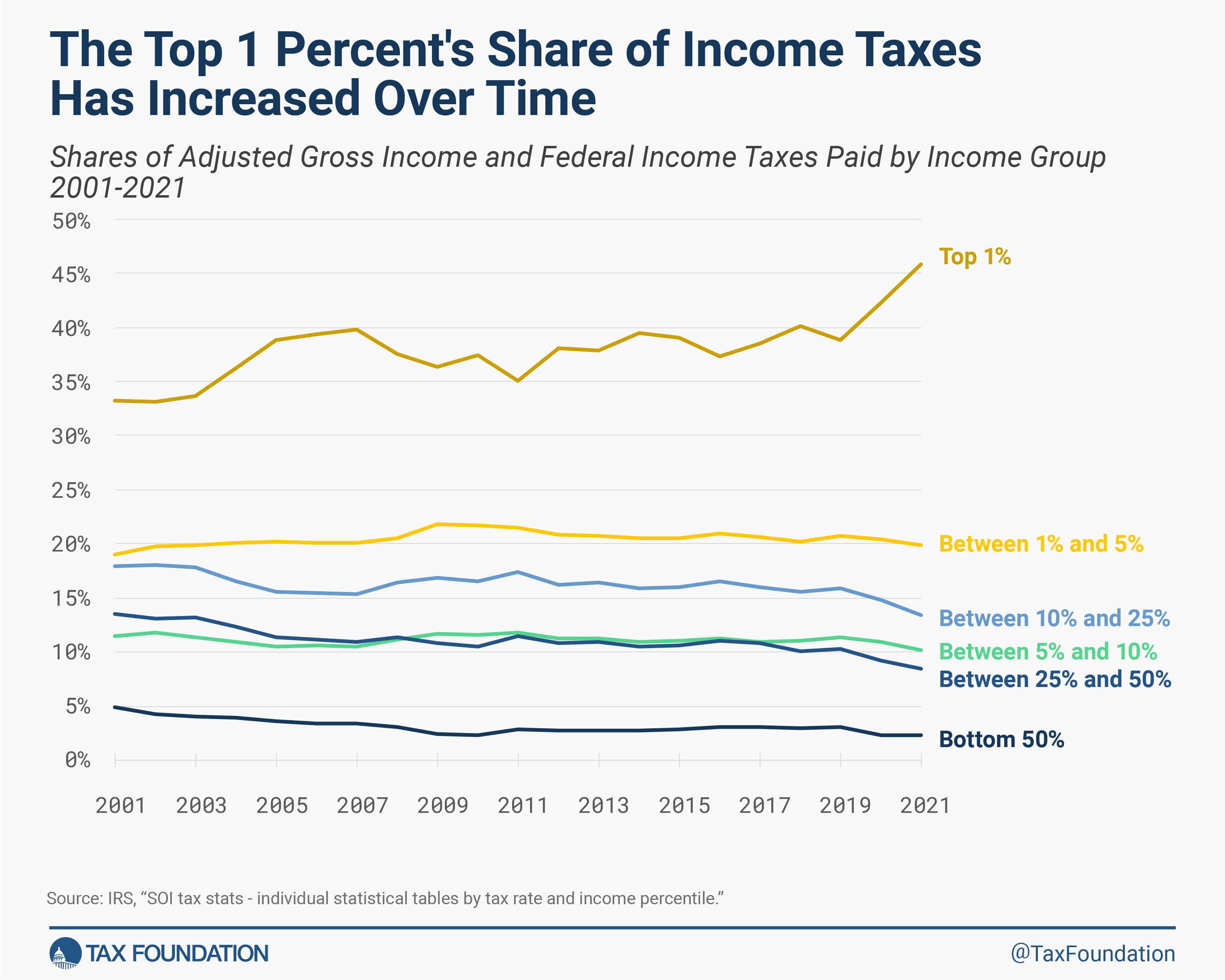

Let me show you a chart that clearly illustrates the fallacy that is

1

May 7, 2024, 12:40 PM

[ in reply to The Democrats love using the "1% need to pay their fair share" ] |

|

our tax code. Specifically the "income tax" most Americans pay.

As you can clearly see, with a top INCOME tax rate of 90%, or a top rate of 29%, or everything in between, the amount of federal revenue has always (since WW2 anyway) been between 15-20% of GDP.

There are inherent limits on what the government can collect from income taxes.

|

|

|

|

|

|

Replies: 31

| visibility 451

|

|

|

to award

the award.

to award

the award.